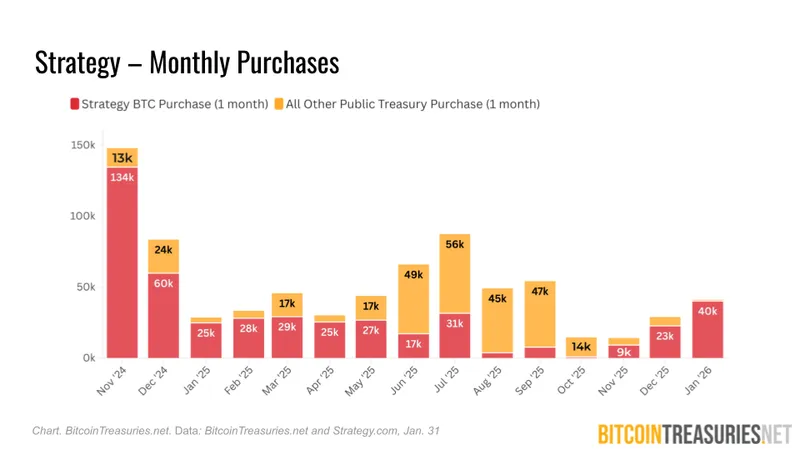

January marked a decisive turn in corporate Bitcoin accumulation, as Strategy’s aggressive buying spree redefined the market’s tempo and concentration.

Rather than starting the year quietly, Strategy began buying at a breakneck pace, accounting for nearly all new additions among public companies this month.

The January 2026 edition of the BitcoinTreasuries.net Corporate Adoption Report tracks this consolidation in detail, pairing treasury movements with spot market and credit data.

Our headline finding: Strategy’s 40,150 BTC purchase brought aggregate public‑company accumulation to late‑summer highs, underscoring how a single player is continuing to maintain its dominance even in weak markets.

Click here to read the full report.

1. Strategy dominated Bitcoin treasury buying

Strategy massively dominated January purchases as it bought 40,150 BTC in January, accounting for up to 97.5% of all public company additions for the month and single-handedly bringing sector-wide buying to levels last seen in late summer.

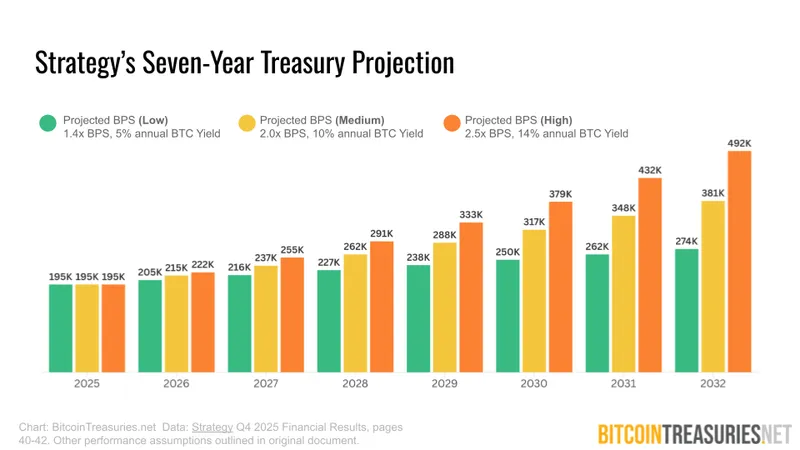

Furthermore, we note that Strategy's aggressive Bitcoin accumulation in recent months aligns with its ambitious seven-year treasury projections detailed in its quarterly report.

Under the most aggressive growth model, Strategy projects 2.5x growth in Bitcoin per share by 2032 for 492,000 BPS in satoshis and 14% annual Bitcoin yield. Even the company’s lesser projections model significant growth.

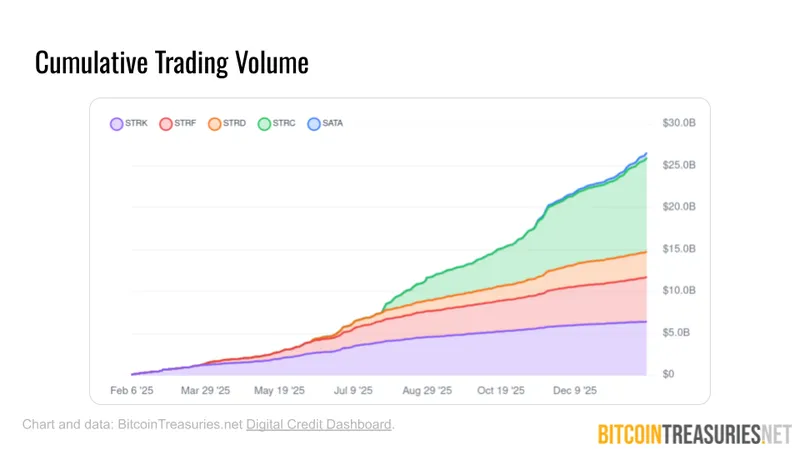

2. Digital credit growth

Our new digital credit dashboard reveals key data focused on Strategy and Strive’s digital credit products, pointing to key growth across the board.

Notably, we estimate $26.8 billion in cumulative volume, made up almost entirely by Strategy’s four main classes of preferred shares — STRC, STRD, STRK, and STRF — with Strive’s SATA accounting for just $765 million of the total volume.

We also observe digital credit prices returning toward par after dipping in November, including Strategy’s STRC briefly touching its $100 target, and yields trending upward since last summer, with Strive’s SATA most visibly reaching 15% yield.

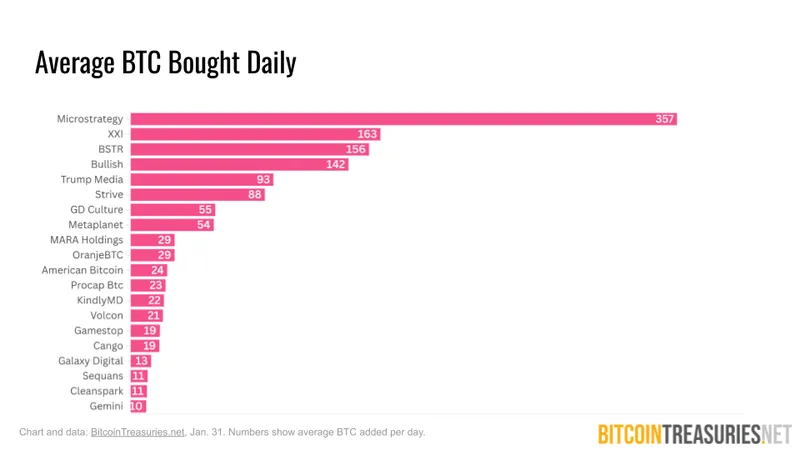

3. Strategy buys 357 BTC on average per day

Many Bitcoin treasuries now have buying strategies that are months or years underway, which prompted us to calculate each public company’s average daily Bitcoin additions.

This points to a single leader: Strategy, which tops the charts with over five years of consistently large purchases averaging 357 BTC daily.

The full report includes data for the remainder of public companies, finding that one-third of current Bitcoin holders add at least 1 BTC per day on average, while twenty public companies acquire at least 10 BTC per day on average.

This measurement does not mean that each company purchases Bitcoin daily – rather, it’s an abstraction that shows a treasury’s size in a way that’s proportionate to its lifespan.

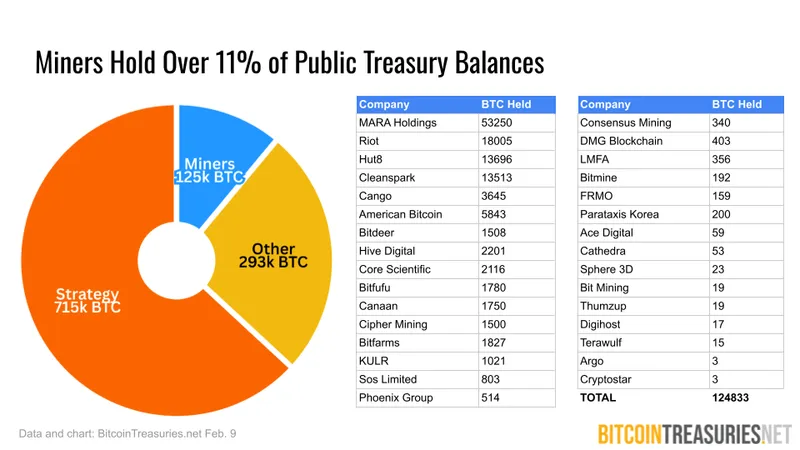

4. Miners make up 11% of treasury holdings

Bitcoin miners remain a significant treasury category, accounting for about 11% of all public holdings overall and a noticeable slice of monthly additions.

In December and January, miners accounted for 7.3% and 3.6% of Bitcoin acquired by public and private treasuries. It should be noted that, when taking Riot and Bitdeer’s January sales into account, miner holding changes were net negative for the month.

Our experts write: “Bitcoin miners represent the treasury sector's most structurally advantaged accumulation model. ... When Bitcoin trades at more than $100,000 per coin and equity markets offer compressed mNAVs, miners acquire Bitcoin at operational costs while peers face hefty dilutive purchases when buying at spot.”

“As a result, mining-based treasuries tend to maintain consistent periodic accumulation regardless of stock price, mNAV, or capital markets access.”

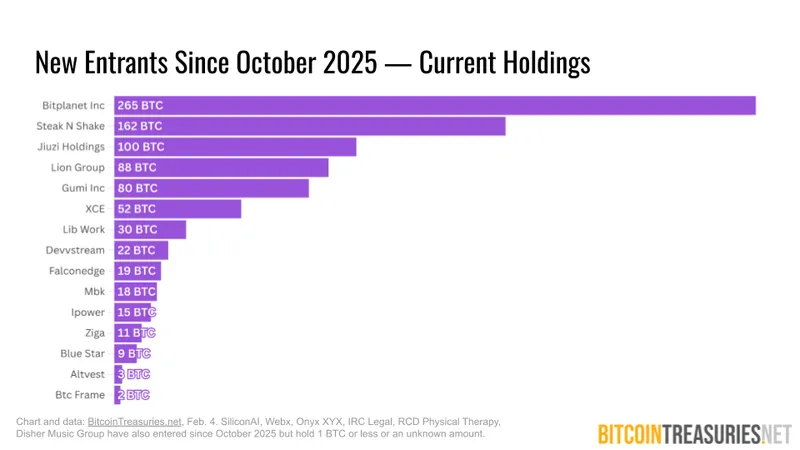

5. New buyers have added 880 BTC since October

We’ve added 21 public and private treasuries to our listings since October, joining the treasury sector as we observe slowed buying activity.

That reduced growth includes fewer new entrants and fewer monthly buyers overall at year's end.

But as activity falls across the board, with roughly 20-30 monthly buyers since November, new entrants’ modest engagement is made more substantial than it might otherwise have been.

As shown below, the top 15 new entrants have accumulated 880 BTC over the past four months — powering about 3% of non-Strategy buying during that time.

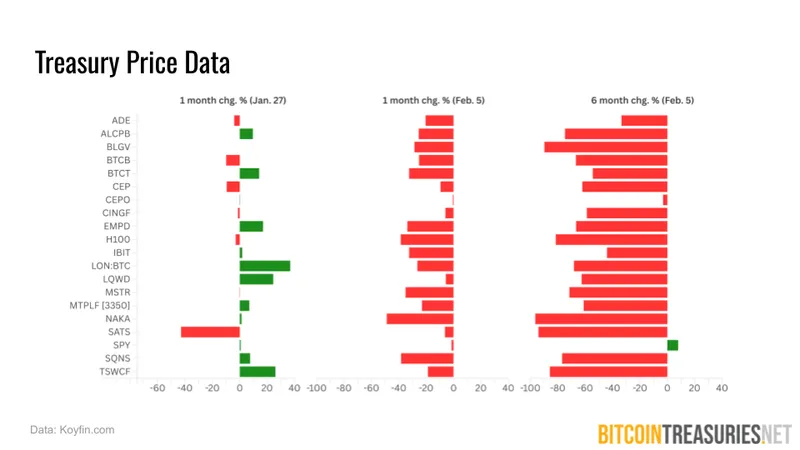

6. The February market crash

February began with a significant market crash as Bitcoin prices fell below $65,000, and this volatility extended to stocks in the treasury sector.

All 18 companies we identify as “pure play” treasuries were in the red for the month-long period ending Feb. 5. KindlyMD, H100, Sequans Communications, and Strategy were hit hardest, with more than a 35% price drop over one month ending on that date.

Late January data initially appeared to be positive, as we briefly saw pure-play stock prices trend upward. On Jan. 28, ten were in the green over one month and 13 were up year-to-date, with many outperforming benchmarks such as the S&P 500 and IBIT.

Bitcoin and stock prices remain low and near-term recovery is uncertain, though our recent audience survey projects broad optimism around treasury stock prices.

For further analysis or to discuss trends driving your investment or treasury strategy, reach out to our research team at [email protected].